What is a Credit Score? Factors, Types & More

Your credit score is more than just a number — it’s a key part of your financial identity. It tells lenders how responsible you are with credit, helping them decide whether to approve you for things like credit cards, car loans, or even a mortgage. Your score typically falls between 300 and 850. The higher […]

Your Credit: Why Credit Reports and Scores Matter to Your Financial Health

Your credit health affects more than just your ability to borrow — it impacts your entire financial future. From qualifying for loans to renting an apartment or even getting a job, your credit report and credit score play a major role in your financial opportunities. By regularly checking your credit and understanding how it’s calculated, […]

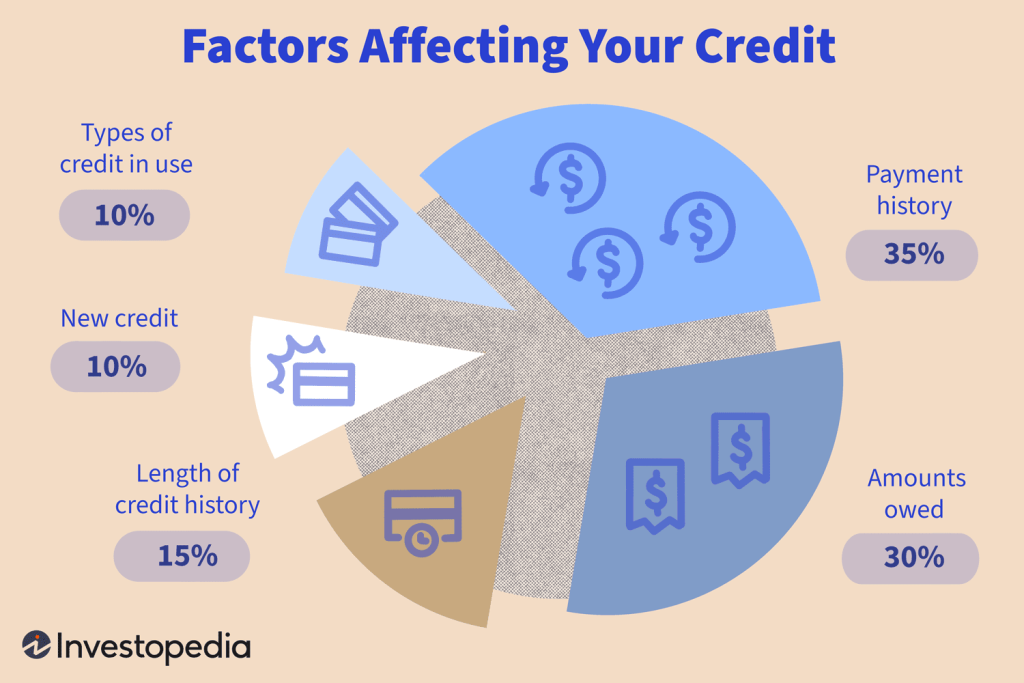

Why Are My Credit Scores Different?

In a nutshell: You may see different credit scores because there are multiple scoring models, and each credit bureau may report slightly different information at different times. This is completely normal — but understanding why it happens can help you make smarter financial decisions. At CreditVana, we give you free access to your credit scores […]

How to Improve Your Credit Score

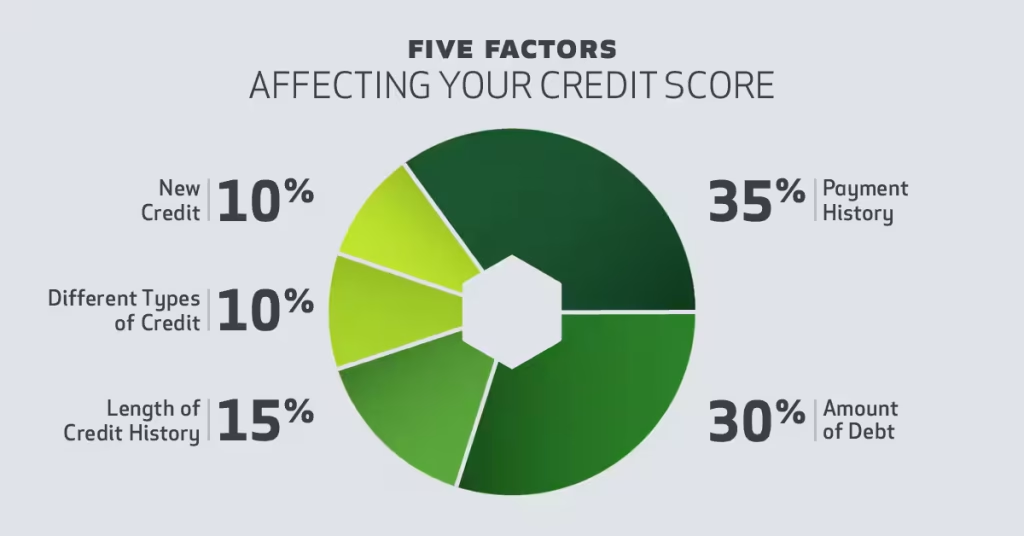

Published October 2025 | CreditVana Insights Improving your credit score can feel overwhelming, especially if you’re just starting out or recovering from past financial missteps. But the good news is that credit scores are built on clear factors, and by focusing on the right habits, you can see results over time. Whether you’re building credit […]

How Do Credit Cards Work?

A credit card is one of the most powerful financial tools you can carry. It gives you access to a revolving line of credit, meaning you can borrow against your limit, repay the balance, and borrow again — without having to reapply for new credit. On top of that, most credit cards come with rewards, […]

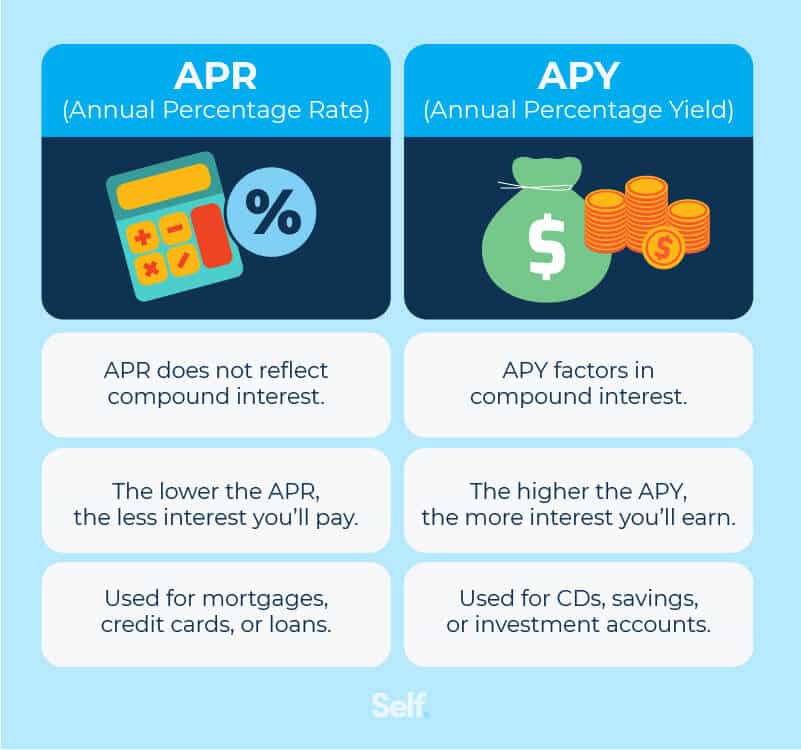

APR vs. Interest Rate: What’s the Difference?

Whenever you borrow money—whether through a loan, mortgage, auto financing, student loan, or credit card—you’re not just paying back the amount you borrowed. You’re also paying the cost of borrowing: interest and sometimes additional fees. Many people think the interest rate tells the whole story, but that’s not always the case. To really compare loans […]

How Do I Know if I Have Debt in Collections?

Having an account sent to collections can feel overwhelming—and it can take a big toll on your credit score. But there’s good news: new scoring models reward you for paying off collections, and tools like CreditVana can help you track your progress, dispute errors, and rebuild your credit with free three-bureau monitoring. How to Know […]

How Do I Check My Credit Score?

Your credit score is one of the most important numbers in your financial life. It affects whether you’re approved for a credit card, car loan, mortgage, or even an apartment lease. It can also influence your insurance rates and in some cases even job opportunities. But here’s the truth most people don’t realize: while dozens […]

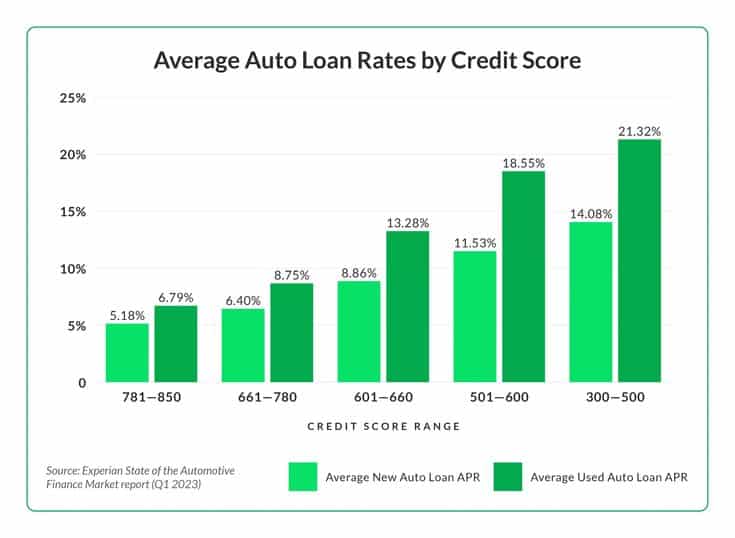

Average Car Loan Interest Rates by Credit Score

Your credit score heavily influences the auto loan APR, monthly payment, and overall cost of financing a car. In Q1 2025, the average APR was 6.73% for new cars and 11.87% for used cars. Your actual rate will vary by credit score, lender policies, loan terms, vehicle, and the broader rate environment. Average Auto APRs […]

How to Contact the Credit Bureaus

The three national credit bureaus—Experian, TransUnion, and Equifax—offer multiple ways to access your credit information, protect your identity, and fix errors. Use this guide to reach each bureau fast, plus learn how CreditVanahelps you monitor all three and spot issues early. Quick Contacts: The Three Credit Bureaus Bureau Website Phone Experian Experian.com 888-397-3742 TransUnion TransUnion.com […]