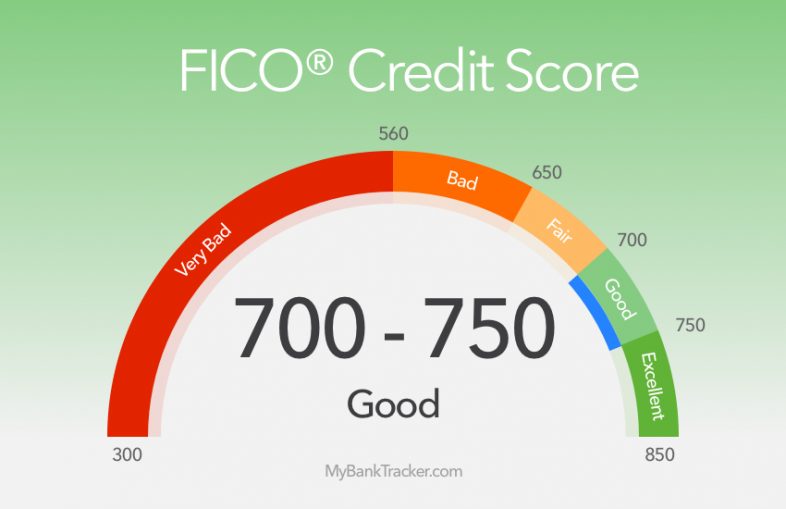

What Is a Good Credit Score?

When it comes to credit scores, knowing what’s considered “good” can make all the difference. Both FICO® Scores and VantageScore® credit scores range from 300 to 850. A score in the mid to high 600s is generally considered good, while anything in the 700s or 800s is excellent. In fact, the average U.S. FICO® Score […]

Why We’re Keeping Both an AmEx Platinum and a Sapphire Reserve

With annual fees creeping higher—currently $695 for The Platinum Card® from American Express and $795 for the Chase Sapphire Reserve®—many cardholders are asking themselves a tough question: Should I keep either of these cards? In one two-person household, the decision was to keep both, paying nearly $1,700 a year in combined fees. Sounds steep? Absolutely. […]

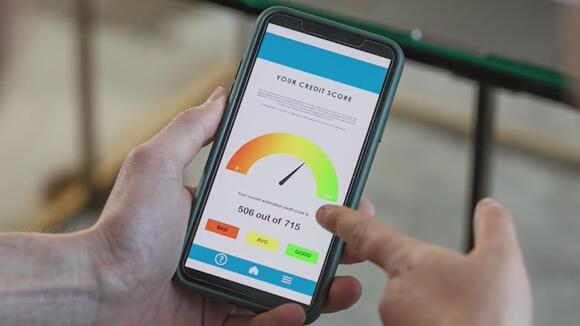

Gen Z Leads Biggest Drop in FICO Scores Since Financial Crisis

The average FICO scores dropped to 715 in April, down from 717 the year prior. Marking the second consecutive year-over-year decline. This dip in the national average is a reflection of broader trends in consumer credit, with increased utilization and delinquency rates contributing to the overall downturn. Gen Z Faces the Largest Drop Among all […]

FICO Reports Drop In National Average Credit Score, Now At 715

Recent data from FICO reveals concerning news: the national average credit score in the U.S. has fallen, dropping by two points since 2024, now sitting at 715. Though a two-point dip might seem minimal at first glance, experts warn that this marks the largest decline since the Great Recession—and it could have significant implications for […]

Credit Scores Drop At Fastest Pace Since The Great Recession

As the cost of living continues to rise and federal student loan payments make their long-awaited return, more Americans are finding it difficult to keep up financially. According to a recent FICO report, credit scores are falling at the fastest pace since the Great Recession, with many borrowers falling behind on car loans, credit cards, […]

Is Your Favorite New Artist Actually an AI Robot?

It took only 13 seconds for an AI tool called Suno to generate a full song based on a simple prompt: make the bass funky, write about a robot musician at an open mic. In moments, the app produced a track called “Digital Dreams.” If you wanted to, you could buy the rights, distribute it […]

Chime Retools Its Secured Card, Adding 1.5% Back on Eligible Spending

Chime has given its credit-building card a serious upgrade. Formerly known as the Chime Secured Credit Builder Visa® Credit Card, the refreshed Chime Card™ still helps you build credit — but now with added perks like cash-back rewards, higher savings rates, and simplified spending management. Here’s everything you need to know about the new Chime […]

Stay In Control Of Your Credit With Our Christmas Credit Countdown

The holiday season brings joy, celebration, and—if you’re not careful—financial stress. Between gift shopping, travel, and festive activities, it’s easy to lose track of spending. But this time of year can also be the perfect opportunity to take charge of your finances and set yourself up for a stronger credit profile in the new year. […]

How Falling Consumer Confidence Affects Personal Finance And Spending

Consumer confidence has taken a sharp downturn, and the ripple effects are shaping how households borrow, spend, and save. While declining sentiment can create uncertainty in the economy, it also gives individuals the chance to pause, reassess, and strengthen their financial habits. At CreditVana, we believe moments like these are an opportunity—not just a warning. […]

Credit Scores And Dementia: A Hidden Connection

When most people think about credit scores, they picture young adults building credit for the first time—or families trying to rebuild after financial struggles. But new research suggests credit scores may also play a surprising role later in life: as a potential early warning sign of Alzheimer’s disease and other forms of dementia. At CreditVana, […]