How Do I Get My Credit Report and Score From TransUnion?

You can access your free credit report and score in multiple ways. Free reports are available from TransUnion®, Equifax®, and Experian® at AnnualCreditReport.com. TransUnion also offers daily refreshed reports and scores through Credit Essentials. Checking your own credit reports or scores is a soft inquiry and does not impact your credit score. Why Credit Reports […]

How to Refinance a Car Loan: A 6-Step Guide

Assess your current financial and car situation to see if refinancing makes sense for you. Define your goals such as lower interest rate, decreased monthly payment, shorter loan duration Check your credit report and score to make sure it’s in a good place to apply for a new loan. Shop around and compare lenders to […]

How Often Do Credit Reports and Scores Update?

Credit reports update whenever lenders send new information to the credit reporting agencies. Your credit score changes when new data is added, removed, or updated in your report. There’s no set day when your credit score updates—it can happen multiple times per month. Lenders don’t all report on the same schedule, so your report may […]

How to Rebuild Credit: 9 Ways to Get Started

Key Takeaways There’s no fixed timeline for rebuilding credit—progress comes from time + consistent good habits. Negative marks don’t last forever and lose impact as they age. Start by reviewing your credit reports so you know exactly where you stand. Use core credit score factors as your action plan to target problem areas. First Things […]

What Is an Inquiry on My Credit Report?

Financing a car lets you pay monthly over a set term until you own the vehicle. Check your credit report and scores first—better credit can unlock lower rates. Shop multiple lenders and compare offers; small APR differences can save thousands. Knowing key loan terms (APR, term length, DTI/PTI, etc.) helps you choose wisely. Some lenders […]

How to Finance a Car: 7 Steps to Get an Auto Loan

Financing a car lets you pay monthly over a set term until you own the vehicle. Check your credit report and scores first—better credit can unlock lower rates. Shop multiple lenders and compare offers; small APR differences can save thousands. Knowing key loan terms (APR, term length, DTI/PTI, etc.) helps you choose wisely. Some lenders […]

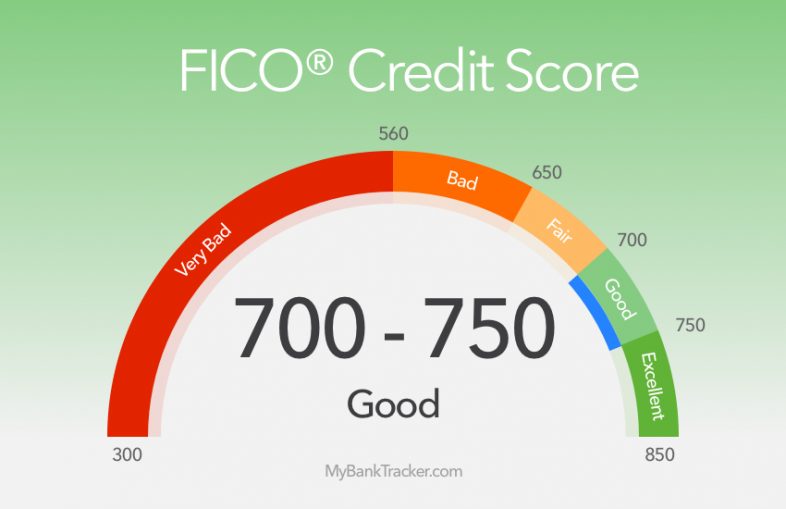

What Is a Good Credit Score?

Key Takeaways A good credit score typically falls in the 661–780 range under the VantageScore® 3.0 model. Good scores come from consistent healthy habits—like paying bills on time and keeping balances low. Your score can change as new information is added, updated, or removed from your credit report. Different scoring models (VantageScore®, FICO®) may show […]

Factors That Impact Your Credit Score

Key Takeaways Your credit score is based on specific information in your credit report. Different providers (like VantageScore® and FICO®) use different models, which may cause slight score variations. The most important factors include on-time payments and how much debt you carry. Understanding these factors can help you improve your credit health and make better […]

What Are Social Security Survivors Benefits?

When we think about Social Security, most people picture monthly retirement checks. But the program provides much more than that. One often-overlooked benefit is Social Security survivors benefits—monthly payments made to eligible family members after a loved one who paid into Social Security passes away. These benefits can be a critical financial lifeline for families […]

Money Market Accounts Explained: Are They Right for You? (CreditVana Guide)

A money market account (MMA) is a type of bank or credit union deposit account that usually earns a higher interest rate than a traditional savings account. With an MMA, your cash can grow faster while staying accessible for short-term needs like an emergency fund or saving for a down payment. At CreditVana, we help […]